Namely, many market participants are now bracing for the Federal Reserve to begin raising interest rates from current near-zero levels starting in March before completing a series of as many as seven total rate hikes over the course of the year, according to some Wall Street pundits. (Photo by Robyn Beck / AFP) (Photo by ROBYN BECK/AFP via Getty Images)

The seven percent increase in the Labor Department's consumer price index (CPI) over the 12 months to December was the highest since June 1982, as prices rose for an array of goods especially housing, cars and food. People shop for groceries at a supermarket in Glendale, California January 12, 2022. "The next CPI release will be March 10, just days before the Fed meets and during their 'quiet period' which will be too late for them to convey any updated thoughts publicly." "This latest look at inflation could get the Federal Reserve talking about a potential half-point interest rate hike at their March meeting," Greg McBride, chief financial analyst at Bankrate, wrote in an email Thursday morning. Though the Fed's dual mandate dictates promoting both maximum employment and price stability, the latter component has taken on increased importance as inflation continues to accelerate to new multi-decade highs.

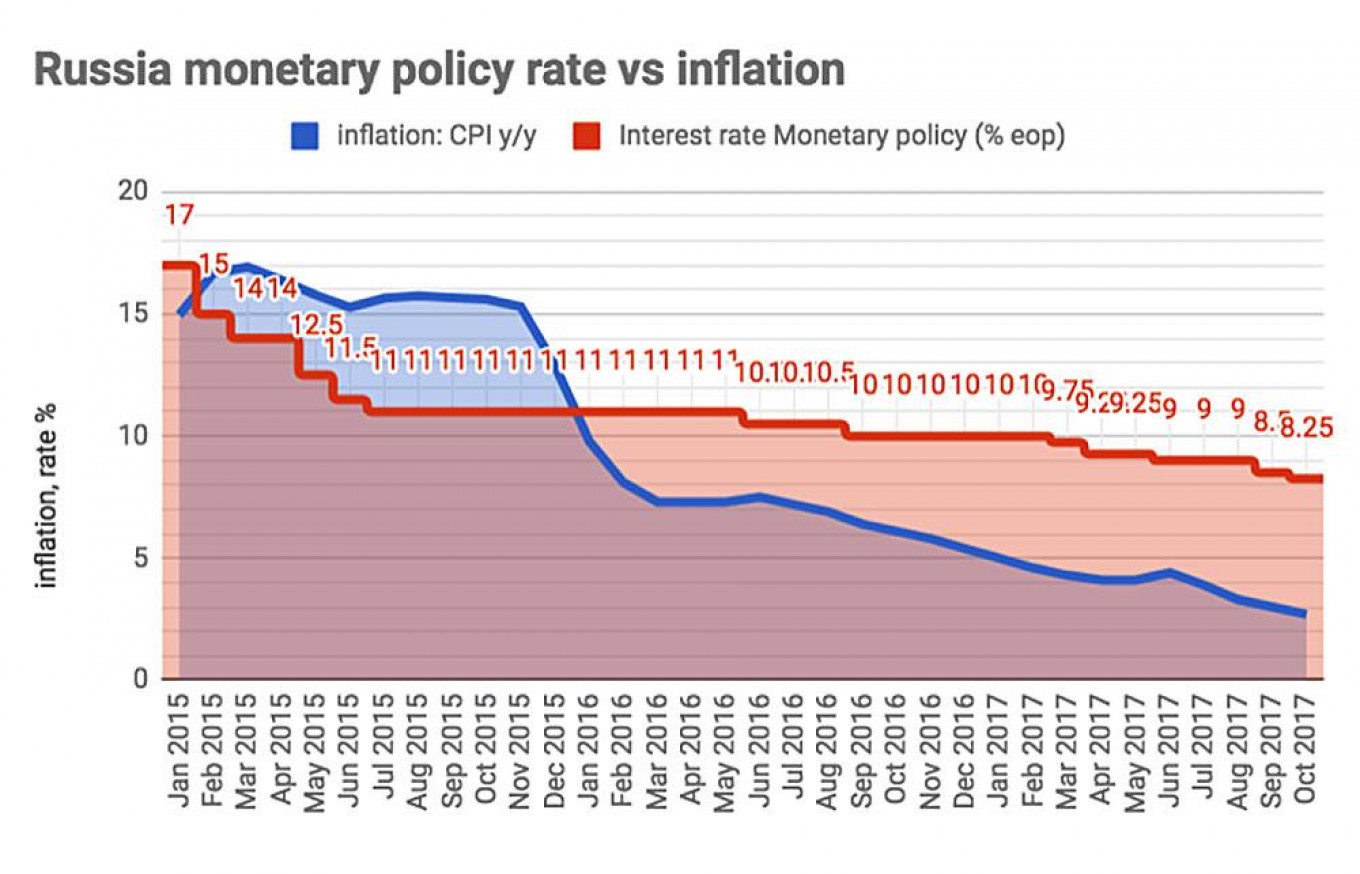

#Inflation 7 years from now update#

Alongside the 0.7% jump in food away from home prices, this underlines our view that a rapid cyclical acceleration in inflation is underway and, with labor market conditions exceptionally tight, it is unlikely to abate any time soon." Inflation and the Fedįor investors, the latest CPI serves as a key update as to whether inflation has continued to run hot enough to justify a quicker shift toward more hawkish monetary policy from the Federal Reserve.

"The acceleration in rent of shelter inflation shows no sign of abating, with owners’ equivalent rent up by 0.4% m/m again and rent of primary residence seeing an even bigger 0.5% gain. economist for Capital Economics, wrote in a note. The 0.6% gain in medical care services prices may also have reflected Omicron disruption, and prescription drug prices also saw an unusually large gain," Andrew Hunter, senior U.S. "With core CPI inflation hitting a new high of 6.0%, there was little to cheer about in the rest of the report. Prices for lodging away from home, however, dropped by 3.9% on a monthly basis in January, as the Omicron surge at the beginning of the year dampened mobility and demand for hotels and other stays. This was in turn led by a 0.5% increase in rent prices, which have risen alongside home prices as affordability concerns pushed many individuals to rent instead of buy homes. Shelter prices - another primary contributor to inflation gains in recent months - climbed by another 0.3% on a monthly basis in January. The core CPI had risen by 5.5% in December. Food at home prices rose 1% during the month, while food away from home prices rose 0.7%.īut even excluding more volatile food and energy prices, the so-called core CPI rose by 6.0% in January over last year, also marking the biggest jump since 1982. Gains in prices for food also contributed to the headline index, as dining at home and out each became more expensive. Electricity prices also jumped by a pronounced 4.2% on a month-over-month basis. Within energy, fuel oil prices jumped 9.5% on a monthly basis, tracking the rise in crude oil prices, which rallied to a seven-year high at the beginning of the year.

Update your settings here to see it.Įnergy prices remained a key contributor to the overall CPI and were up by 27% on a year-over-year basis in January. This content is not available due to your privacy preferences.

0 kommentar(er)

0 kommentar(er)